If you’re not sure how to get started with crypto, you’ve come to the right place. In this chapter of our Crypto 101 series, we’ll introduce you to how to purchase cryptocurrency, sharing tips and best practices on where to get it, which kinds to opt for, and ways to store it afterward.

Key takeaways:

- Start by determining what kind of cryptocurrency you’d like to get, as you can opt for popular crypto like Bitcoin, stablecoins like Tether, or choose in favor of altcoins.

- There are several options regarding how to get crypto: designated exchanges like Coinbase, peer-to-peer marketplaces, traditional brokerages, and a few more.

- How do you buy cryptocurrency? The specific procedure and terms will depend on the selected medium and currency, yet it usually entails using either regular money like US dollars or trading another cryptocurrency.

- Make sure your purchased crypto is securely stored, so select safe wallets, don’t lose your keys and credentials, and use complex passwords.

Choose Which Cryptocurrency to Buy

As you’re just getting started with crypto and how cryptocurrency works, you must decide what you’re planning to purchase. So, first things first, what kind of cryptocurrency do you need? You basically have several paths at this point.

Popular Cryptocurrencies and Stablecoins

As such, you could buy some of the most well-known cryptocurrencies like:

- Bitcoin (BTC);

- Ethereum (ETH);

- Tether (USDT);

- Solana (SOL);

- Binance Coin (BNB);

- Dogecoin (DOGE);

- XRP;

- and so on.

These typically have a large market cap and seem like the safer option. But they often come at a high price, mostly due to their broad acceptance and a reputation of relative stability.

Some of them, like Tether (USDT) or TrueUSD (TUSD), are stablecoins. Their value remains consistent since fiat currencies like US dollars back them. This means you can typically exchange or redeem such coins for as little as one US dollar.

Altcoins and Alternative Currencies

You can also go for something that’s much less-known but gaining popularity in the crypto space instead. There are lots of cryptocurrencies created as alternatives to Bitcoin or other big names that might deserve your attention. Litecoin, Cardano, Storj, Myro, Algorand, and VeChain are just a few examples that may have potential.

Popular Coins for Gambling and Web 3.0

If you’re aiming to use crypto to place bets in crypto casinos or for other games, then you can opt for some of the top gambling tokens, which may be platform-specific. Giving a few examples of commonly used crypto gambling coins apart from stablecoins like Tether or Ethereum, here are a few widespread options: Shuffle (SHFL), Rollbit Coin (RLB), FUNToken (FUN), Litecoin (LTC), WINk, Ripple (XRP), and Decentral Games Token (DG).

Likewise, if you’d like to play games within Web3 ecosystems, there are various coin options to spend in virtual worlds as well. Some common ones are Binance Coin (BNB), Decentralized (MANA), The Sandbox (SAND), Axie Infinity (AXS), and Gala.

To get the coin types mentioned above and use them for gaming and casinos, you can go to the major crypto exchanges like Gemini or Kraken, which sometimes offer platform-native tokens for specific platforms and ecosystems, or turn to gaming-specific exchanges like Gate.io or KuCoin.

And here’s a tip: consider combining assets and purchasing more than one type of currency. Either way, your further actions will greatly depend on what you select.

How Do You Buy Cryptocurrency?

Aah, that heart-thumping moment of making your very first crypto purchase. Here’s a brief run-through and general overview of the step-by-step process.

Step 1: Decide Where to Buy Crypto

So, where can I buy crypto? Yup, this is one of the most often-asked questions. First, you have to select your provider. There are a few places to go for getting coins if you want to buy cryptocurrency and trade it.

The most common options include:

- cryptocurrency exchanges;

- peer-to-peer marketplaces;

- traditional online brokerages;

- payment applications;

- crypto ATMs.

We’ll go over the peculiarities of each path later in the article, including how to make a purchase and what to note. But at a top level, if you decide to go to an exchange, to stay on the safe side, begin with those that have a good reputation and a large user base like Kraken. If you decide to explore other options for getting crypto, do your homework beforehand to find out everything you can about the terms, fees, anonymity, available cryptocurrencies, security, the rules for how to buy coins (like whether you can buy crypto with fiat money or only other crypto), and so on.

Step 2: Possibly Go Through Verification

The next step depends on the selected path in the previous step. For instance, to get crypto on an exchange, you’ll need to get an account on the platform and go through Know Your Customer (KYC) ID verification, while crypto ATMs typically require only a phone number. , On the other hand, while peer-to-peer marketplaces often offer anonymity, you will still need some personal information to register on the platform.

Step 3: Indicate What You’re Buying

Then, choose the cryptocurrency you want to buy. The currencies are often labeled with abbreviations (a.k.a ticker symbols). Also indicate how much you’d like to purchase. With some coins, especially Bitcoin, you can buy fractional shares. The prices are usually formed according to the market rates that change daily and on the providers’ terms.

Step 4: Select the Payment Option and Add Funds

How do you get cryptocurrency, exactly? Luckily, you don’t have to take out your miner’s suit and heavy metal equipment. You can get it either by paying regular money or by trading one cryptocurrency for another.

- Using cash — Fiat money is probably the option you’ll get started with if you don’t have any crypto yet. This is government-issued paper currency or, in other words, the regular money we keep in banks and are accustomed to using like US dollars, euros, and so on. This option for buying crypto is available on most exchanges, brokerages, Bitcoin ATMs, and other paths. Note, though, that you might have to report such transactions when doing your taxes.

- Using other crypto — Alternatively, you can trade one type of cryptocurrency for another. For instance, if you own a fraction of Bitcoin (its smallest subunit is called a satoshi), you may purchase crypto like Ethereum or some other digital currency with it. We’ll go over the steps in more detail later.

What you can pay with, the methods, and the available trading pairs depend on the provider. So, choose your payment option like debit card, bank transfer, or other method. At this point, you’ll likely see an estimate of how much crypto you’ll get.

Step 5: Add Storage Details and Finalize the Transaction

Next, you need to provide information on where the crypto you’re buying should be stored. Essentially, you’ll need to provide your wallet details (for instance, scan a QR code of your wallet), select the storage form a drop list, or use a temporary one generated for you automatically. Once again, the specific options depend on the provider and path you choose.

Double-check that everything is correct in the preview, and finalize the transaction. If everything goes well, the purchased cryptocurrency will then be credited to your wallet.

Step 6: Store Your Crypto

Now that you have some cryptocurrency, you need to take care of its storage and ensure it’s secure. There are a few storage solutions for the purchased crypto.

Option 1: Keep it in a temporary wallet — Once you buy cryptocurrency, it may be transferred to a temporary wallet or stay on the on-platform storage provided by the exchange. The latter path can be handy if you want to take advantage of the exchange’s staking offers or continue trading on a daily or weekly basis. But the thing is that exchanges may be vulnerable to theft and hacking, so you need think about protecting your assets. If you want to do more with your crypto apart from staking and keep it somewhere very safe, then you might consider option 2.

Option 2: Move it to a designated cold or hot wallet — Alternatively, you can transfer the crypto to an external wallet for safety purposes. Mind, though, that there could be transfer fees like those set by the exchange. You can go for either hot or cold wallets. Hot wallets are connected to the internet, they’re easy to access and convenient if you plan on making frequent trades, but are more prone to cyberattacks. Cold wallets, in contrast, aren’t online and are good for long-term storage. They come in different forms, including hardware wallets which are similar to a USB drive.

A Few Good-to-Knows About Crypto Wallets

You’ll also likely come across these terms, here’s a brief comparison of custodial vs. non-custodial crypto wallets:

- Custodial wallet (when a wallet provider that normally charges fees for this third-party service holds a user’s private keys, so you need to trust them to keep your assets safe);

- Noncustodial wallet (an autonomous option, when a user is in complete control of the private keys, stores their own crypto, and holds responsibility for managing it and keeping it safe).

Buying Crypto on Cryptocurrency Exchanges

Now let’s move on to the specific ways to purchase crypto if you’re not a very experienced user wondering “Where can I buy cryptocurrency?”. A dedicated exchange could be a great starting point. There are lots of them, yet, just as with regular cash exchanges that sell physical fiat currencies like US dollars or British pounds, not all have the full spectrum of cryptocurrencies on offer.

That’s why the following three centralized cryptocurrency exchanges (CEXs) for digital currencies may be your first stop, as this could be the best way to buy crypto when you’re just taking your first steps. Here’s what you should know about these well-known platforms where you can buy, sell, and trade almost any kind of crypto that exists.

Kraken

Key figures: 100+ cryptocurrencies

Founded in 2011, it is one of the biggest and most reputable exchanges in the world. It supports over 100 cryptocurrencies, from popular ones like Bitcoin and Ethereum to dozens of altcoins, and is available in 13 languages, including English, Spanish, French, Korean, and Chinese.

Kraken provides advanced trading features (like margin trading with leverage or futures trading), tailored services for institutional clients, and even staking, which allows for passive income generation. Overall, the platform is highly secure, has competitive fees, and a user-friendly interface.

Coinbase

Key figures: 200+ cryptocurrencies and crypto assets

This leading cryptocurrency exchange was created in 2012 and is a great choice for both seasoned traders and newbies without prior experience. Importantly, it provides comprehensive educational materials and tutorials, simplifying the learning curve for those who don’t know how to buy digital currency or use the platform.

You can trade more than 200 cryptocurrencies there, as well as non-fungible tokens on its NFT marketplace. Coinbase has a neat interface, is very secure, has multilingual support (11 languages), and offers safe wallet storage. A few cool things? You can get crypto-backed loans or even a Coinbase Card, which is a Visa debit card linked to crypto that automatically converts your crypto to regular money when you use it in stores or make online payments.

Binance.US

Key figures: 100+ cryptocurrencies

If you’re unsure how to buy cryptocurrency in USA, this prominent cryptocurrency exchange that was launched in 2019 can be a good choice. It’s a subsidiary of the global Binance platform that serves American users. It offers a diverse choice of more than 100 cryptocurrencies available for exchange. It supports more than 6 customer service languages like English and Spanish (while the non-US platform has over 20).

What makes this exchange special? It has attractive staking rewards and over-the-counter (OTC) trading options for those seeking large trades, which often interests institutional investors. All in all, it’s a safe crypto trading environment with an intuitive interface.

How to Buy Crypto on Exchanges

Step 1: Choose an Exchange

Going for a renowned exchange might be the best way to buy cryptocurrency if you haven’t done this before. There are so many crypto providers, we get it, but the three options we suggested earlier (Kraken, Coinbase, and Binance) could be worth investigating.

Step 2: Create Your Account and Verify It

You’ll then need to go to the exchange, either by downloading the exchange’s app or accessing it on your computer via a web browser. Next, get an account on the exchange or platform, which most likely means you’ll have to sign up, register, and provide some personal details requested for regulatory compliance.

The platform may require various identity-confirming information for the verification process like your name, email, address, and phone number. Sometimes you can be asked for your social security number, to answer a few questions, and even submit a copy of your passport together with a photo of yourself to prove it’s really you.

Once the verification is complete, you’ll get a notification and be able to access the platform using your password and credentials for login. This will be your key to how to get into cryptocurrency exchanges.

Step 3: Add Funds to Your Crypto Account

As we’ve already mentioned, you’ll probably start by purchasing it with traditional money. There are a few common ways to fund your account, including:

- linking your bank account;

- initiating a wire transfer;

- using a debit card;

- using payment systems like PayPal or Google Pay.

Exchanges have their own terms but keep in mind that the deposited fund might not be available right away, a several-day waiting period is okay. If you somehow already have some crypto and want to buy more with it or trade it, choose an exchange that supports the trading pair you need. Then, to fund your account, transfer your crypto assets to the exchange (if they aren’t already there) from your wallet.

Step 4: Buy Cryptocurrency

After funding your account, you’re all set to make your first crypto purchase. Navigate to the trading tab or Buy/Sell section in the exchange. Choose what you want to buy and the quantity, and complete the transaction via the selected payment method.

The procedure will be similar if you decide to buy crypto with other crypto. You’ll need to choose the trading pair, for instance, Bitcoin to Dogecoin, and how much you want to trade. The purchased crypto will be stored on the platform on your account, but you’re free to move it to an external wallet.

Possible Fees for Buying Crypto on Exchanges

Apart from the fact that the prices for select cryptocurrencies change by the day, you must also mind the associated costs, commissions, and fees charged by the exchange. The total fees can really add up, as a percentage could be collected for trading, deposits, withdrawals, and so on. Here’s a brief overview of the terms that three popular exchanges have:

| Kraken | Coinbase | Binance.US | |

|---|---|---|---|

| Low-Volume Trading Fees | For makers: 0.25% For takers: 0.40% | For makers: 0.40% For takers: 0.60% | For makers: 0.38% For takers: 0.57% |

| High-Volume Trading Fees | For monthly volumes of over 50k: 0.24% for takers and 0.14% for makers | For monthly volumes of over 50k: 0.25% for takers and 0.15% for makers | For monthly volumes of over 50k: 0.2375% for takers and 0.1425% for makers |

| Bank Transfer ACH Fees | None | None | None |

| Credit/Debit Purchase Fees | 3% to 4.5% | 3.99% | Around 3.5% |

| Withdrawal Fees | Depend on the withdrawn currency and method | To a bank account: free Instant debit card withdrawals: ~1.5% of the amount | Depend on the withdrawn cryptocurrency |

Comparison Table: Common Crypto Exchange Fees

What else should you note? Most fees are determined by how much you trade throughout a 30-day period and the charged percentages differ from platform to platform. For instance, Binance has 0% fees on Tier 0 pairs (the digits in the table are for Tier 1). Plus, Kraken has a feature for converting small balances less than the minimum order size but charges a 3% fee. Its terms also differ for stablecoin purchases like USDT, DAI, or USDC.

What is more, all of these platforms provide staking opportunities, and users can earn rewards for locking up specific cryptocurrencies on the exchange, yet the percentages differ. Either way, you should look into the terms if you want to learn how to get started in crypto.

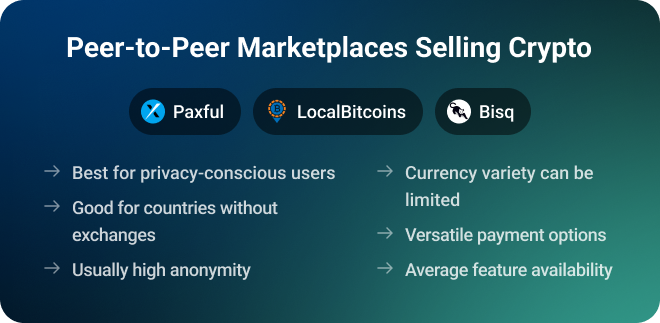

Getting Crypto on Peer-to-Peer Marketplaces

Another approach to how to get cryptocurrency is to access a peer-to-peer (P2P) marketplace. They are considered decentralized ones, as the users’ transactions are direct on such platforms, that is, users can buy and sell crypto to one another without an intermediary. Paxful, LocalBitcoins, Binance P2P, and Bisq are a few examples.

P2P marketplaces for cryptocurrencies don’t keep users’ funds, meaning that they’re not as attractive to hackers. Smart contracts are utilized to facilitate transactions, checking and guaranteeing that certain predetermined conditions or criteria are met. An escrow service is sometimes employed in order to protect both parties during the transaction. Yet typically buyers and sellers can make direct transactions with minimal intervention on the platform’s end.

The adoption and popularity of decentralized exchanges is on the rise, yet when it comes to overall trading volume, centralized exchanges (that do serve as a middleman) still dominate. Why do many opt for P2P marketplaces? Mainly because of:

- the typically low fees;

- more anonymity;

- the flexible payment options (bank transfers, digital payment systems, and others);

- there’s no need to disclose private keys.

How to Buy Crypto on P2P Marketplaces

To start trading on P2P platforms, select the one that suits you best. You’ll then need to register an account and might have to verify your identity. Personal information isn’t usually shown while trading though.

The rest of the procedure is similar, you select the type of crypto you want to buy, how much of it you need, the type of payment method you prefer, and maybe even the location if it matters. Then, browse through the options in the listing that are filtered by the criteria you indicated and compare the rates and offers.

Mind the sellers’ exchange rates and trading limits when making up your mind. Many P2P platforms also use community ratings to assess a trader’s credibility which also helps. You can judge a potential trading partner’s trustworthiness based on the star or percentage rating in the user profile based on their feedback from other users. A score like “97% positive feedback” can be a good sign, especially if the account is detailed. If you take the time to click on the user’s profile, you may often browse their transaction history, uncovering details like how many trades they’ve completed or their volume. If you see platform badges like “Trusted Seller” this can also signal credibility. Bottom line: if you’re a first-timer, start with small transactions and aim at someone with a 95% or above rating and a frequent and high trade count, moreover, read the comments.

When you find an offer you’re interested in, start the trade by opening the trade window, make the payment according to the seller’s instructions, and confirm that you sent the payment. After the seller confirms they’ve received it, crypto should appear on your account wallet. You can transfer it to an external wallet afterward if you’d like.

Fees for Crypto on P2P Marketplaces

Some P2P platforms charge trading fees. For instance, Paxful charges around 1-2% and it depends on the selected payment method, while Binance P2P doesn’t charge takers but has a 0.35% fee for makers.

Note that some sellers may have their own exchange rates and can charge you more than the market rate due to the additional anonymity of such marketplaces. But you can secure yourself by opting for the P2P’s commonly offered escrow service which can hold on to the assets until the transaction is complete. Such marketplaces also often have a dispute resolution system in place just in case.

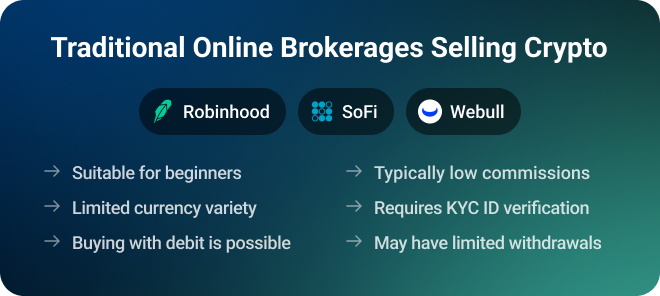

Purchasing Crypto on Traditional Online Brokerages

Turning to the traditional brokers is another option of where to buy cryptocurrency. Ordinarily, they offer more than just crypto, are well-structured, and have good interfaces. There aren’t many of them that cater to trading cryptocurrencies, yet, Robinhood, SoFi, Webull, eToro USA, TradeStation, and Interactive Brokers are several of the prominent ones.

Getting Crypto on Traditional Brokerages

Choose the online brokerage that supports the cryptocurrencies you’re interested in buying. Create an account on the platform and complete the verification process, which is similar to that on crypto exchanges.

It is possible that you’ll need to deposit funds into the account to buy crypto, which is the case for eToro. The required minimum for the preliminary deposit amount is typically decided by the brokerage. You can use bank transfers or debit cards, but note that it may take time to link the payment method, and verification can take a couple of days. Not all of them require account funding, though, for instance, Robinhood doesn’t if you link up a bank account.

Once you’re ready, you can select the cryptocurrency you’d like to purchase, the amount, and choose if you’d like to buy it immediately or when the price reaches a certain limit (a.k.a. limit orders). Once you review the translation details, confirm your purchase by placing your order. Usually, assets appear quickly if it’s an immediate purchase. Nevertheless, if you’d like to move your assets from the brokerage to an external wallet, you may face limits.

Possible Crypto Fees on Traditional Brokerages

As a rule, fewer currencies are available on brokerages, and they set their own exchange rates higher than the market price. But the commissions are usually low, typically between 0.1% and 4%. For example, Robinhood doesn’t charge trading fees and provides instant power for buying crypto for up to 1 thousand USD once you connect your bank account.

Yet, you shouldn’t expect staking or other features that would let you make money on interest, as these platforms are designed for slightly different purposes. On the contrary, you might also be charged a fee for storing your crypto on the brokerage and might have to pay fees for inactivity or withdrawal.

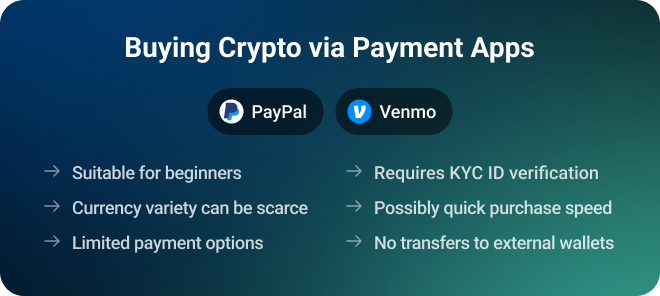

Using Payment Applications to Get Crypto

Most of you have used PayPal or Venmo at least once, right? Then keep in mind that these payment services have recently made it possible to make various transactions using some common cryptocurrencies, including purchasing and selling crypto.

Don’t expect advanced trading options, but you may use the educational resources for learning how to buy digital currency. PayPal and Venmo support crypto storage, letting you keep such assets there, yet do not allow for external wallet transfers or moving your assets to different exchanges. This means that the purchased crypto will stay within the app’s ecosystem.

What can you buy with crypto? Lots of things, really, as millions of online merchants use PayPal as their payment gateway. But this isn’t the right choice if you want to use these crypto assets directly in Web3 games, crypto casinos, or NFT marketplaces, they are incompatible, and you’ll need multi-step workarounds.

Buying Cryptocurrency via Payment Apps

Using a payment processor like PayPal can make crypto really accessible, as you can buy it directly within the application. You’ll need to download the app to your device if you don’t have it yet and go through registration, which implies filling out account details like your phone number, email, and setting a password. Most likely, you’ll need to go through identity verification to confirm who you are.

Next, you’ll need to link up your debit card or bank account for making crypto purchases. Then, go to the home screen or menu of the application and select the crypto you need among the available currencies for purchase. Browse the price charts showing the latest data and enter how much you’d like to purchase (the minimal amount is 1 USD). Once the information on the transaction is reviewed, complete the purchase. It’ll then be stored within the app.

Possible Fees for Buying Crypto in Apps

Such apps often have slightly higher exchange rates than the market rates, expect a markup of about 0.5% to 1%. These applications often charge fees based on the purchase amount. As such, both PayPal and Venmo charge around 0.49 USD for 1 to 49.99 USD, 1.99 USD for 100 to 200 USD, 1.8% of the transaction amount if it’s up to 1000 USD, and 1.5% if it’s over 1000 USD.

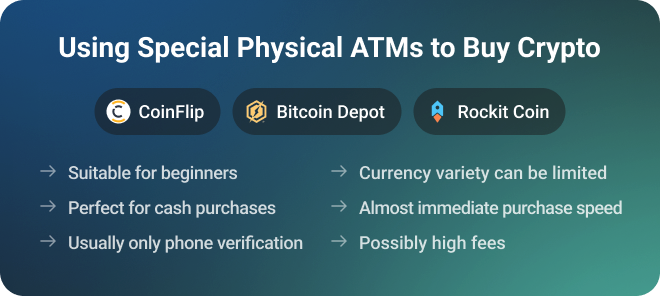

Opting for Crypto ATMs

Finally, have you heard of crypto ATMs? These special machines similar to regular ATMs are an alternative to traditional exchanges. Around 34,000 Bitcoin ATMs are already installed in public spaces around the globe (you can use this map to find one near you). If you’re in the USA or Canada where most of them are located, this could be the easiest way to buy crypto, just check beforehand that the ATM supports the currency you want to buy.

How to Buy Crypto Using Crypto ATMs

The process is simple. Tap “start” on the ATM screen, agree to the terms, and indicate how much of which cryptocurrency you want to buy. Next, you’ll need some sort of identity verification, usually, you have to indicate a phone number to get an SMS verification code. But if you’re planning on buying large sums (way more than 100 USD), you’ll likely need to scan your ID.

Then, the machine asks you for your crypto wallet address where you want to transfer the purchased cryptocurrency. You can scan a QR code on the ATM’s screen or use the temporary wallet the ATM may generate and print for you.

To buy Bitcoins and sometimes other cryptocurrencies, you’ll need to swipe your debit card or insert cash, depending on what the ATM allows. At this point you’ll likely be shown the approximate crypto amount you’ll receive based on the current rates. If you confirm, press “Buy”.

Once you make the transaction, you’ll see a “Done” sign on the screen and get a receipt. Expect the purchased crypto to appear on your wallet within the next 10 minutes. It can work the other way too, some ATMs even let you sell your cryptocurrency in exchange for cash also with the help of QR codes.

Possible Crypto ATM Fees

Also mind that you may be charged a transaction fee of 7% to 20% or higher. This depends on the crypto ATM operator, as such, the most common CoinFlip-run ATMs charge fees within the 7-12% range, while niche ones can charge up to 20%. Plus the fee depends on the ATM’s location (high-traffic ones may have higher fees) and the type of transaction (i.e., selling is usually “cheaper” than buying when it comes to associated fees).

So, Which Option Is It?

If you’re unsure which path is best for you, here’s a comparison table, drawing a line for the mentioned above.

| Cryptocurrency Exchanges | Peer-to-Peer Marketplaces | Traditional Online Brokerages | Payment Applications | Crypto ATMs | |

| Best For | Regular trading | Privacy-conscious users or those in countries without exchanges | Beginners | Beginners | Beginners, cash purchases |

| Anonymity | Low (requires KYC ID verification) | High (usually no KYC requirements) | Low (requires KYC ID verification) | Low (requires KYC ID verification) | Medium (only phone number for small amounts) |

| Currency variety | Wide selection of currencies | Often very limited | Very limited selection | Often scarce | Often limited selection |

| Feature Availability | Many advanced features, including staking | Average | Average | Low | Very low |

| Purchase Speed | Medium, transactions may take longer | Medium to rather slow transaction times | Rather quick if it’s within the brokerage | Could be quick | Almost immediate |

| Payment Options | Versatile, including cash | Versatile, including cash | Buying with debit is possible | Limited | Usually debit card or cash |

| Fees | Competitive | May be low | Medium, yet with limited withdrawals | May be high, limited withdrawals, no transfers to external wallets | May be high |

| Security | Mostly robust | Average | Average | Mostly good | Average |

And what’s for some tips and major takeaways:

- Go for a reputable crypto exchange if you need a user-friendly interface and intuitive experience. You’ll have a large selection of coins and currencies but will have to verify your identity.

- If you want more privacy, choose P2P marketplaces. There’s no such incline on mandatory Know Your Customer policies, and some alternative payment options are often available.

- In case your investment portfolio is diverse and you have lots of other assets besides crypto, a traditional brokerage can be a safe path. Yet, it’s not the best option if you plan on moving your crypto off the brokerage’s storage options.

- If you’re seeking a hassle-free crypto buying experience with a familiar payment app like PayPal, you’re more than welcome to do that. This is a nice path if you have small purchase amounts in mind, but you won’t be able to move crypto assets beyond the app’s ecosystem, as it can be stored only there.

- If you have a crypto ATM around the corner or, say, in your town’s big mall, this can be a super easy way to buy cryptocurrency. It’s more or less anonymous (only a phone number is usually required for small purchases), yet implies fees up to 20%.

- Finally, if you’re using crypto for gambling or gaming, ensure the crypto provider is compatible with the platform you have in mind. For instance, payment apps like PayPal are not a suitable option. Also, keep an eye on the recharge capabilities. As such, you might need a solution that’ll give you the chance to limit yourself from spending irrationally and gambling irresponsibly, yet one that can allow you to proceed to a certain extent on the terms you indicate.

Tips on How to Buy Cryptocurrency for Beginners

Now that you know what is buying crypto all about, here are several best practices we haven’t mentioned yet.

Be on Guard of the Volatility

If you see cryptocurrency as an investment opportunity and are buying it due to the possibility of getting high returns, note that this asset is much more “turbulent” than traditional stocks or real estate. Cryptocurrencies are prone to experiencing sharp fluctuations and rather unpredictable price swings. As such, even Bitcoin’s value can drop by 20% or more in just one day.

Therefore, you have to keep your hand on the pulse in terms of volatility and bear in mind that digital currencies are a rather young phenomenon, so their trajectories are harder to predict. What can you do to insure yourself? Invest in various assets to diversify your portfolio, keep an eye on the trends, use automated stop-loss orders, and spend time educating yourself in order to not end up empty-handed.

Only Invest Spare Funds

The high likelihood of getting a substantial return for your crypto investment comes with equally possible risks. Hence, you have to be aware of this downside and be prepared that there is a danger of your assets decreasing or even losing their value.

Once again, you can spread your investment into several different assets to mitigate risks and minimize potential losses. And by all means, don’t put all of the funds you own into crypto if you won’t make ends meet in case of their loss. It doesn’t have to be a gamble, so don’t jeopardize your financial well-being.

Gamble Responsibly

Likewise, if you want to use crypto for gambling, placing bets, and so on, be on the lookout for the platform’s capabilities to help you save your assets. For example, some platforms like MetaMask allow for setting spending thresholds. You can also set limits on the allowed withdrawals and deposits, while some solutions even implement self-exclusion options if you want to suspend yourself for some time.

Avoid Funding Your Account via Credit Cards

While using a debit card for purchasing cryptocurrency is a common practice, using a credit card might not be the best idea. Some brokers and exchanges allow this kind of method, yet this practice typically leads to significant expenses due to a 5% cash advance fee on top of the rest of the exchange commissions. In the end, you could lose up to 10% of your purchase due to various fees.

Learn About the Terms for Moving Your Crypto

It makes sense to find out about the provider’s policy for moving your cryptocurrency in advance. For example, although brokers can be a very appealing option for trading, some popular ones like Robinhood don’t allow users to move their crypto assets off their platforms.

This might not seem like a particular area for concern at first, yet experienced traders usually prefer to keep their crypto on secure wallets of their choice, some are even offline. It helps to know about these kinds of terms early on.

Make Sure Your Crypto Is Safely Stored

The type of wallet you store your crypto on is up to you, you can even leave it in the exchange for a while if you don’t have much. But mind security, as the last thing you’d want is to have your personal data compromised or to lose your money. As emphasized previously, security is integral when dealing with cryptocurrency. Instead of asking “How can I buy cryptocurrency?” or thinking about how to do it profitably, you should be worrying about safety.

2FA, or two-factor authentication, is a safety precaution to follow. Some platforms like Coinbase even have crime insurance to keep their clients’ assets safe.

Yet the least you can do is use strong passwords. As such, exchanges are an attractive target for looters, so you should opt for those with a proven track record. The same recommendation applies to selecting a wallet. In fact, opting for several storage types is a best practice.

Safeguard Your Private Keys

Make sure not to lose your private keys that prove your crypto ownership. For instance, if your assets are on an exchange and you forget the access codes, you risk permanently losing the savings stored in your account. Yes, some providers have recovery options, but this may be a nerve-wracking process with no guarantees.

If you lose your keycodes to a cold wallet or the device you keep it on breaks, there are even more risks. You might lose your crypto forever due to theft, getting locked out, or because there will be no way to retrieve it.

Summing Up How to Get into Crypto

Hopefully, we’ve given answers to your major questions like “How do I buy crypto?” or “What can I buy with cryptocurrency?” We’ve covered the basics in this part of the guide with recommendations and must-note steps. You are free to test out various exchanges, platforms, and purchase paths to see what works best for you. In the following chapter, we’ll dive deeper into the details of storing purchased crypto.