Have you decided to use cryptocurrencies? Terrific! You’re about to get into an exciting world beyond currency centralization. If you want a piece of the action, you have to know how to get a crypto wallet to securely store your digital assets. However, before you do that, you first need to understand what they are. To help you get started, we’ll talk about the different kinds of crypto wallets, explain what they’re for, and how to create them.

Key takeaways:

- A crypto wallet is a means for managing and accessing your cryptocurrency funds.

- There are various types available, including hot and cold wallets, as well as custodial and non-custodial ones.

- Public and private keys are necessary for extracting data from the blockchain and approving transactions.

- Recovery phrases are generated to provide access to your crypto assets in emergency cases.

What Is a Crypto Wallet?

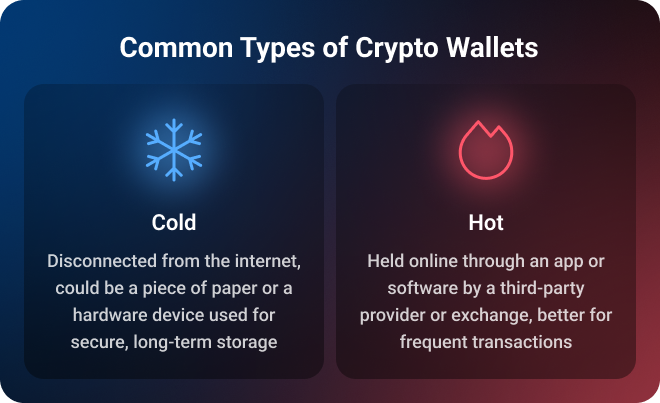

A crypto wallet is a tool that’s somewhat similar to a customary digital wallet but used to access and manage your crypto balances. You’ll come across a few of their kinds: online and offline, or hot and cold crypto wallets.

Although the wallet might provide a familiar interface, it doesn’t directly hold crypto assets as regular digital wallets hold cash or cards. Instead, it serves as a bridge that interacts with the blockchain where your coins and tokens exist and all transactions are recorded.

This is made possible because your cryptocurrency wallet stores keys that you need in order to get access to your crypto. The following can prove your ownership: a public key that’s available to anyone and a private key ensures that you’re the one authorizing the transaction.

We hope that’s clear! Your crypto wallet is like a hybrid of a digital banking app and password manager forming a gateway to your assets. It doesn’t hold funds in the same way as an e-wallet and it doesn’t store your purchased cryptocurrencies.

How Do Crypto Wallets Work?

Your coins are held in the blockchain, where all transactions involving crypto are recorded. But if you don’t actually have coins in your wallet, what’s the point of having a wallet for crypto?

As we’ve mentioned, it’s a necessary means for accessing your crypto. Without a wallet, you won’t be able to receive, send, or manage it. For instance, if you want to view your crypto balance, the wallet retrieves information from the blockchain to reveal how much you currently possess.

Remember that we talked about how these wallets hold public and private keys? Both of these are vital components for accessing and protecting your assets. So, when you create a digital crypto wallet, you’ll get such a unique combo:

- Public key, which is like an account number or wallet address that’s unique to you, you can share it with other people and it gives you the capability to receive crypto.

- Private key, which is like a password usually made up of randomly generated characters that give you control over your crypto, so you shouldn’t expose or share it with anyone.

How Do You Use Crypto Wallets and Keys?

Let’s say you’d like to send some crypto to someone. To initiate the transfer, you’ll have to access your wallet. Then, to move the funds, you’ll need to indicate the amount, enter the person’s public key, and sign the transaction using your private key. Once it’s confirmed and validated in the blockchain network, the amount will be deducted from your wallet balance and the recipient will get the crypto.

A Recovery Phrase in Crypto Wallets Explained

What if you lose your private keys or your offline wallet gets stolen or damaged? Well, if someone steals the device, it might mean you lost your funds forever. If it’s damaged though you’ll likely be provided with a recovery phrase when setting up the wallet.

It’s like a backup phrase consisting of random words (there are 12 to 24 on average) that you can apply provided you’ll need to regain access. Luckily, the phrase usually isn’t tied to a specific wallet, device, or software. If it’s wallet-agnostic, you can use the phrase to recreate your wallet on a compatible solution. Plus, your funds are tied to the blockchain.

What Are the Different Types of Crypto Wallets?

Essentially, there are two categories of crypto wallets: hot and cold. However, there are a few subtypes of each.

Hot Wallet

All hot wallets are held online through an app or software. Your private keys are also there. Most software wallets are hot wallets, a few popular examples include MetaMask or Coinbase Wallet.

Because the user needs an interface for viewing their crypto balance, sending crypto, and performing other functions, software will inevitably be part of the equation. Hot crypto wallets are preferred by many due to simple accessibility, and since they’re online, they are better for frequent transactions. Nonetheless, this also means they are more vulnerable to cyberattacks and hacks.

Cold Wallet

The only way for a crypto wallet not to be considered a hot wallet is if it’s permanently isolated from the internet. In this case, it becomes a cold wallet.

There’s no app involved, it could be installed on a disconnected device, and even a key written on a piece of paper counts as a cold wallet. Giving a few examples with more physical durability than paper, hardware wallets like Trezor Safe 5, Ellipal Titan, Ledger Flex, or Ledger Nano Range are widespread. Such solutions are completely offline (or are offline most of the time), making them more secure from online hacks. Some can be plugged into a computer like a USB device or connected using a cable, others are equipped with Bluetooth or support QR code-based transactions.

This type is considered a more secure crypto wallet option. It’s optimal for long-term storage or keeping large amounts since it’s safer due to its detached nature, yet it isn’t as handy for daily usage. Plus, since the market for cold wallets is smaller, your options are not as extensive as those for hot wallets, but you can come across various types, even metal storage.

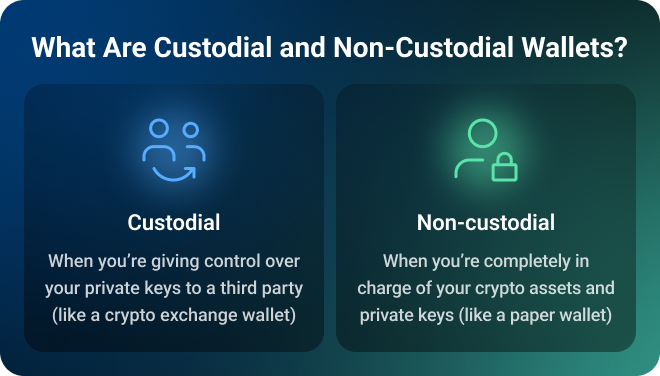

Custodial and Non-Custodial Wallets: What Do These Mean?

Apart from hot and cold and the categorizations mentioned, you can also classify crypto wallets based on the level of control that you have over your funds.

Custodial Wallet: Advantages and Disadvantages

This is the case with many hot or online wallet options when you’re giving control over your private keys to a third party. Who can be in charge of keeping your funds and private keys secure for you? The provider of standalone wallet solutions, a cryptocurrency exchange like Coinbase, or some other third-party solution offering on-platform storage or wallets. At least from your end, it will be like using a regular digital currency wallet.

By choosing a custodial crypto wallet, you get to enjoy the following benefits:

- Less personal responsibility. It’s not just on you to keep your coins secure, which takes the pressure off.

- User-friendly platform. Custodial wallets are great for beginners who are only making their first steps into the world of crypto.

- Easy recovery. If you lose access to your account, you can get back in with recovery phrases.

These wallets also come with certain disadvantages:

- Less secure. Your crypto funds and personal data are stored online, which makes them more prone to hacking. However, cryptocurrency wallet development continues evolving, and reputable custodians have already taken some steps against this disadvantage like storing a portion of the crypto entrusted to them in cold wallets.

- Limited control. Since they’re the ones holding the private keys on your behalf, you’re relying on them to green-light your transactions. Also, there’s always the possibility that they’ll freeze your account, which may prevent you from retrieving your crypto.

- You need to go through KYC and other verification procedures. Custodians are usually bound by laws that require them to ask for additional information from you.

Does this mean you shouldn’t ever use a custodial wallet? Not necessarily. These are things that you normally have to encounter when dealing with a financial institution.

Non-Custodial Wallet: Advantages and Disadvantages

If you want to be completely in charge of your crypto assets and private keys, this type of wallet is definitely the best option. With a non-custodial wallet, you don’t have to share your private keys with anyone. When creating one, you’ll be presented with a list of words that you’ll have to write down and store somewhere safe. This will be your only way of regaining access.

By opting not to have a custodian to manage your crypto funds, you enjoy these benefits:

- Complete control. You have full access to your coins anytime you want as long as you have your private keys.

- More secure. Most non-custodial wallets are offline, where no online hacking can take place.

- No KYC or verification is required. The whole point of crypto is decentralization, and you get to fully enjoy this advantage when you go with a non-custodial crypto wallet.

Before committing to this option, we recommend assessing if you can manage these disadvantages:

- Potential to lose access to the funds. Losing your keys and recovery passwords means saying goodbye to your funds forever!

- Not as user-friendly. If you’re a beginner, you may find it harder to set up a crypto wallet this way.

- Potential security risks. Access to private keys means access to the funds, so such crypto wallet security isn’t flawless. So, if someone else gets your keys, they can steal your money.

Therefore, be ready to do the work to ensure that you prevent these potential downsides.

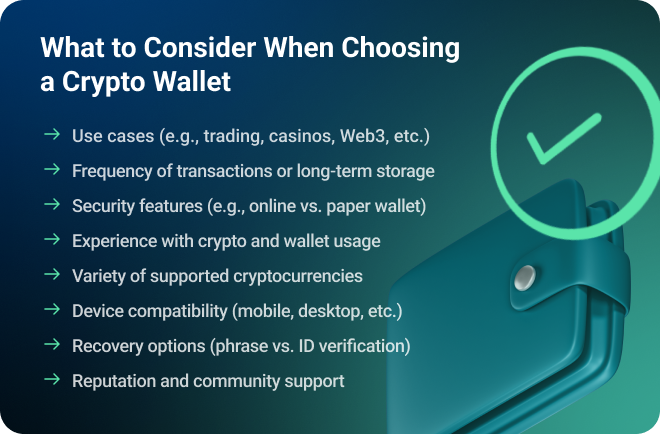

How to Choose the Right Crypto Wallet for You

At this point, you already know the different kinds of wallets and their advantages. You already have ideas on your options for each type. So, how do you choose the perfect one for you? Here are some major considerations.

Use Cases

Some wallet types are better suited for specific use cases. Here are a couple of scenarios you should mind:

- Many people are into cryptocurrency trading. Active traders usually have a combination of hot and cold wallets. They use online ones, such as built-in wallets on cryptocurrency exchanges for a part of their crypto to facilitate fast transactions, and cold wallets for long-term asset storage. Some people keep crypto assets on exchanges for staking purposes (to earn passive income for storing crypto on the platform).

- If you’re using crypto at online casinos, you’ll probably want to create a hot wallet because you’re transferring funds to enjoy an online service. Yet select those that are compatible with casino platforms, are privacy-focused, have multi-currency support, and offer the necessary anonymity that many people who gamble are seeking.

- Those who are exploring decentralized apps like Web3 platforms, crypto gaming, and NFTs, should also prioritize wallets with compatibility. For example, if you’re into a certain game, you need a crypto-gaming-friendly wallet that supports your platform and specific currency.

Other Considerations

1. Frequency of transactions — If you don’t plan on moving your crypto around often or have large amounts, a cold wallet is the more convenient option, while hot wallets are perfect for quick access. The best part is that you can have both kinds.

2. Security features — We’ve gone to lengths to set out how a cold wallet is more secure. But even if it’s true, a physical or paper device is not your best option if you tend to lose things a lot. Either way, key access is synonymous with fund access, so it’s all about identifying the security features that will serve you the best regardless of the used wallet type.

3. Experience with crypto — If you’re a newbie, hot wallets might be better because their interfaces look like those of e-wallets. You’re also more likely to start off small, which means you don’t need the hack-proof advantage that you get with a paper or hardware wallet.

4. Supported cryptocurrencies — These days, crypto wallets support multiple cryptocurrencies. Still, it’s best to check beforehand to make sure you can use the one you’re interested in to buy, sell, or use your preferred coins. However, we don’t recommend compromising on the security and overall quality of the crypto wallet just to accommodate a few extra currencies. You can always make a different one!

5. Device compatibility — If you prefer to use your phone, then a mobile wallet is the best option for you. This same standard applies to cold wallets. For example, you can choose a hardware wallet that can be connected via USB, Bluetooth, and/or a dedicated app.

6. Recovery options — With a non-custodial wallet, you need both the private keys and the recovery phrase. But with a custodial wallet, you might be able to regain your access through email or identity verification.

7. Reputation and community support — Whether you want to use a hot or cold crypto wallet, it’s always a huge plus if your preference is also shared by many others. The official customer support for your chosen wallet might be great, but with community support, you get access to a wealth of first-hand knowledge and experience with dealing with the wallet.

How to Create a Crypto Wallet

Let’s assume that you’ve already identified the best type of crypto wallet for you. How do you set it up? Check the following subsections for the step-by-step instructions on how to open a crypto wallet based on the kind that you prefer.

Creating a Cold Crypto Wallet

As mentioned previously, cold wallets could come in different formats, the most common are paper and hardware wallets.

How to Make a Crypto Wallet That’s Paper-Based

Getting a paper wallet is very simple. Since it’s a physical document containing information about your keys, it could come in QR-code format or lines of text and numbers like passwords.

If you’re unsure how to get a wallet address for paper storage, use a wallet generator like this one to create your public and private keys. For extra safety, download and run the HTML file of the generator offline so that your pair of keys isn’t exposed to online hackers.

Then, print the keys or write them down. It is best not to store this information digitally. Ascertain that you don’t lose this paper or that it doesn’t get damaged by water or somehow else.

To receive crypto assets from the blockchain to this paper wallet, use the generated public address, for instance, in an exchange or by sharing this receiving address with another person. To access your funds, input the private key into a compatible software or hardware wallet.

How to Set Up a Crypto Wallet That’s Hardware-Based

Creating a hardware wallet is a little different. You need to buy a wallet device (say, order it on official websites like Ledger or Trezor), unbox it, and connect it to your computer with a cable, via USB, Bluetooth, or otherwise. Sometimes you’ll also need to download a companion app such as Ledger Live.

Then, follow the manufacturer’s setup instructions. Usually, it entails creating your PIN, generating a recovery phrase, writing it down from the screen, and re-entering it on the device for confirmation. To have a safe crypto wallet, make sure to store the 12 to 24-word recovery phrase and the device itself securely offline.

All security measures that you’ll employ involve physically preventing anyone from accessing your private keys. The procedure for using a hardware wallet to receive or transfer assets is similar to paper, except you’ll need to use the device.

Creating a Hot Crypto Wallet

This option normally starts with downloading or installing an app on a compatible device or using a browser extension online. Then, based on the specific crypto wallet that you went with, the next steps could look roughly like this.

How to Get Crypto Wallet Storage via an App

You can store your crypto assets on software or mobile wallets if you crave portability. To get them, you’ll need to either download and install the application to your computer or smartphone (for instance, you can get the Exodus crypto wallet on the official website or get MetaMask on Google Play or the App Store). Such wallets are often online ones.

Launch the application on your device and click “Create New Wallet”. Follow the setup instructions and set a secure password or PIN. Such wallets generally provide recovery phrases for backup, so write them down and store them somewhere safe.

Mobile wallets can also offer additional security means like face recognition or biometric logins like fingerprint confirmation. But you can also improve the safety of a software or mobile app wallet by activating two-factor authentication.

You can then test the wallet by sending a small amount through the newly created address, for example, from an exchange. If the transaction goes through, you did everything right.

Getting A Crypto Wallet Online via a Browser

Finally, you can get a cryptocurrency wallet that’s web browser-based. These are customarily standalone online wallet solutions, wallets that you’re offered by exchanges when making a crypto account, or other similar platforms.

You can access them using Chrome, Safari, or whatever you’re accustomed to using, as long as you’re connected to the internet. Some browser-based wallets even have extensions that you can download for faster access.

The rest of the steps are similar to the previous kind, go to the website, create an account or use your credentials for login, click “Create New Wallet”, and come up with a password. You’ll be given your keys, and you can send and receive funds by applying them.

Relevant Data Backup and Recovery Procedures

Do you want to keep your crypto funds secure? Take advantage of the backup and recovery procedures that your chosen crypto wallet supports and follow the matters of precaution suggested in these tips.

Safeguard the Recovery Phrase and Private Key

Never lose your recovery phrase that is like your master key. This is the list of words provided to you while setting up your wallet to help you regain access to your account. Write them down on paper instead of typing them into a notepad on your laptop or taking a picture. Remember that digital means can be hacked online.

Don’t share this information with anyone, just as your private keys. You can even keep more than one copy of your recovery phrase, say, one in a deposit box in a bank as backup and the other in your home safe or vault. Some people even split the recovery phrase into pieces and keep them in separate places physically or by using special programs.

Password Management and Identity Verification

Apart from using a strong password for your crypto digital wallet, it can be helpful to use a password manager. This means you don’t have to type your login credentials every time you want to access your funds, which reduces the risk of phishing.

With custodial wallets, you may also be able to regain access by contacting customer support, undergoing account verification, or submitting a form. The goal for any of these methods is to ensure that it’s actually you who’s trying to get into the account.

Be Cautious and Avoid Rookie Mistakes

You can sidestep many mistakes by being on guard. For instance, some wallets are currency-specific like solely Bitcoin wallets, and may not support the ones you need, so learn about this before getting the wallet. Moreover, keep your wallet software updated to obtain the freshest security patches, and don’t click on suspicious links to not fall prey to phishing scams.

Plus, always double-check the public keys when moving assets. If you send it to the wrong address, this may be irreversible, so you can entrench yourself by sending small test amounts first.

What to Do If You Need to Recover the Wallet

You can encounter different unpleasant situations like forgetting a password to your online wallet or your hardware wallet device can break. Either way, you’ll need a compatible solution (i.e., to install a compatible wallet application or buy one more hardware wallet device) to import your recovery phrase to restore the wallet.

If someone steals your device, the person won’t be able to transfer funds without your recovery phrase. So if the phrase isn’t exposed, you can use another device to restore the wallet.

In any of the described cases, you can then move funds and generate a fresh new recovery phrase to stay on the safe side. Losing the recovery phrase usually means you’ll have to permanently part with your funds, they’ll be inaccessible, and you won’t retrieve them.

Major Takeaways

A crypto wallet connects you to the blockchain, makes accurate records of your crypto balances, and ensures that your funds are safe. We talked about the different classifications of crypto wallets and the factors to help you pick the best option (from the use cases and transaction frequency to the desired level of security and others). Now you know about the ways to create a crypto wallet and their recovery methods. The best part is that you don’t have to fully commit to just one crypto wallet. In the next chapter, we’ll go over how to buy cryptocurrency.