People go to specialized crypto marketplaces to get cryptocurrency. But what is a crypto exchange, and which kind should you choose? On this page, we’ll uncover cryptocurrency exchange peculiarities and their different types, comparing use cases and terms. We’ll also share tips on selecting the right exchange, the possible limits you can face, and what to do to keep your assets safe.

Key takeaways:

- Cryptocurrency exchanges are online platforms where people can buy, sell, and trade digital currencies to further utilize them for trading, gaming, online gambling, or other activities.

- There are three major types of cryptocurrency exchanges: centralized (like Binance or Kraken), decentralized (like Uniswap or PancakeSwap), and peer-to-peer (like LocalBitcoins or Paxful).

- It is integral to select a secure and reputable exchange regardless of its type and follow security measures to safeguard your crypto assets and personal information from theft.

- Leaving large funds in the online wallet of a centralized currency exchange can be risky as the platform can potentially get hacked.

What Is a Cryptocurrency Exchange?

Cryptocurrency exchanges are digital platforms where individuals can buy, sell, and trade crypto assets. It’s like a virtual marketplace where you may swap one cryptocurrency for another or change traditional fiat currencies such as US dollars or euros for crypto and vice versa. People use crypto exchanges because it’s an easy way to convert funds, which you can use for trading, gaming, online betting, or other crypto-related activities.

BitcoinMarket.com was the first existing cryptocurrency trading platform that was launched back in March 2010 soon after Bitcoin (BTC) itself appeared in the beginning of 2009. Its main purpose was to make it possible for crypto enthusiasts to trade their Bitcoin assets for US dollars. This Bitcoin exchange was a real breakthrough in the ecosystem, leading to a wider adoption of virtual currency. Other major online cryptocurrency exchange pioneers include Mt. Gox and BitInstant.

What were their main aims? Primarily, exchange creators wanted to:

- make Bitcoin transactions more accessible for users, as before such marketplaces existed, trading or converting Bitcoins to fiat currencies was a struggle;

- create liquidity and establish fair pricing for cryptocurrencies;

- encourage broader adoption of crypto, making it easier for people who don’t know what is a Bitcoin exchange to join the digital economy on a global scale and get involved in cryptocurrency trading.

Such exchanges have gone a long way since then, turning into feature-rich platforms. Some are centralized and controlled by a single company, offering staking opportunities and lots of other cool opportunities. Others are decentralized and shift focus to the blockchain, facilitating trading without intermediaries. Either way, their fundamental goal of making it effortless to exchange digital assets remains unchanged.

How Are Crypto Exchange Rates Determined?

But how exactly are cryptocurrency exchange rates or prices set on exchanges? Unlike the case with fiat currencies where central banks or other authority bodies regulate or dictate the rates, crypto prices on individual exchanges are platform-specific. In other words, rates are typically affected by the participants’ trading activities on the platform, along with the market dynamics, supply and demand, and other factors.

However, you can check the global market rate and average prices on resources like CoinMarketCap or CoinGecko which aggregate fresh data to use as a reference.

What else can shape cryptocurrency pricing? Lots of things, really, including:

- the platform’s trading volumes (even the number of participants on an exchange may influence the prices);

- liquidity (price swings can occur if the cryptocurrency doesn’t have high trading volumes);

- coin supply (how many coins of a specific currency are available overall, if there’s a capped or scarce supply, this affects the price);

- demand (can be impacted by external factors like news, regulations, security breaches, partnerships, level of adoption, or even speculation).

As a rule, if a lot of people participate in the exchange and the trading volumes of a certain cryptocurrency are high, its prices are more stable and consistent. But all of the mentioned above creates opportunities for arbitrage, when you buy cryptocurrency cheaper on one exchange and sell digital assets for a higher price on another, helping align the rates across the market.

Different Types of Crypto Exchanges

What kinds are out there? And how do they differ? Understanding cryptocurrency exchanges can get easier when you grasp the basics of three of their types.

Centralized Crypto Exchange (CEX)

Examples: Binance, Coinbase, Kraken, Gemini

Centralized exchanges function sort of like traditional stock markets and serve as an intermediary platform where people can trade, buy, and sell crypto assets. As middlemen, such private companies or publicly traded corporations control the trading process and can hold crypto funds for you. In this case, you trust this third party to handle your money and execute transactions, but CEXs are typically regulated by a governmental authority. They are good for beginners and traders who give preference to liquidity and simplicity in use.

How do centralized exchanges work? People can buy and sell crypto on CEXs according to the current market price, called the spot price, or they can place limit orders that’ll get activated when an asset hits the desired target price. The trading mechanism is order-based, so the matching engine on the exchange finds the optimal transaction prices and charges a fee for the transaction.

Advantages of CEXs

- Centralized exchanges are often the starting point for beginners due to their convenience: user-friendly interfaces, mobile app availability, and more.

- These platforms make buying and selling crypto easy, offering walk-throughs, step-by-steps, and cryptocurrency exchange support for customers to help newbies and resolve issues.

- You can expect a large variety of cryptocurrencies to select from, including mainstream and niche ones.

- Liquidity and trading volumes are generally high, meaning that the prices are usually stable.

- There are plenty of trading pairs available too, like fiat-to-crypto, crypto-to-crypto, and derivatives.

- Fiat on-ramp is also available, which makes it possible to convert fiat money into cryptocurrencies, fiat deposit, debit cards, and bank transfers are typically supported.

- Transaction speed is also high.

- you can store crypto assets in the exchange’s on-platform wallet.

- Often packed with advanced features like stop-limit orders, futures trading, borrowing money from the exchange and margin trading, and even staking that lets you earn on stored crypto.

- Generally gives recovery options in case a user loses their access.

Disadvantages of CEXs

- On the downside, since centralized exchanges store crypto assets, they are a common target for hackers, so there’s a real risk that the funds can get stolen (this has happened before with Coincheck, FTX, Mt. Gox, and many others).

- Private keys that give access to funds are held by the exchange, not the users themselves, and when you’re not in possession of your keys, you sort of don’t own the assets to a full extent, leading to custodial risks.

- If you want to reap the blockchain benefit of anonymity, you won’t be able to do it, as apart from creating an account, you’ll have to complete identity verification (KYC), which requires documentation and can take time.

- Exchanges often operate under government regulations, this means that since it’s a regulated crypto exchange, there could be censorship within the system like legal restrictions, limited accessibility by region, prohibitions, frozen accounts, blocked transactions, or user suspension.

Decentralized Crypto Exchange (DEX)

Examples: Uniswap, PancakeSwap, SushiSwap, dYdX, Curve Finance

A decentralized exchange takes the “central authority” out of the equation. Such platforms use distributed ledger technologies, operate on blockchain technology, and rely on tech protocols that let users make direct trades. They’re also non-custodial, so users get to control their funds without outside cryptocurrency exchange regulations. DEXs are autonomous, have less censorship, and offer more privacy but are typically more complex.

How do decentralized exchanges work? Traders interact directly with one another on DEXs. Trades between users happen on the blockchain with trade terms encoded into smart contracts. The DEX matches users who want to sell and buy using liquidity pools (collections of funds provided by users) or automated market makers (AMMs set prices based on the assets’ ratio in the pool). Transactions are validated on the nodes of a blockchain network like Ethereum, and people pay gas fees to compensate validators on the blockchain for processing and confirming their transactions. It’s like paying for electricity for the energy your appliances consume.

Advantages of DEXs

- Users have control over funds thanks to the non-custodial nature of DEXs, trades happen directly from user wallets.

- Such a cryptocurrency exchange platform provides better privacy and anonymity for users, as identification procedures like KYC/AML are generally skipped.

- If we compare a centralized crypto exchange vs DEX, no central authority regulates DEXs, which means it can’t control how crypto exchanges work, manipulate trades, interfere with or block transactions, even shutting down the exchange is tough.

- Higher security since DEXs don’t store user funds on-platform, instead users retain and take custody of their own private keys and are therefore the only ones responsible for them.

- Can feature new tokens, altcoins, or cryptocurrencies with small adoption that are rare and often unavailable on centralized exchanges.

- May offer innovative features and support actions like yield farming, token swaps, and liquidity pools.

Disadvantages of DEXs

- Liquidity is typically lower, and since the trading volumes may be lower than on CEXs, prices are usually less attractive and cases of price change slippage during trades are possible.

- Fiat-to-crypto conversions are usually not an option on decentralized exchanges, so using regular currency like USD could be impossible.

- Exchanging assets that are recorded on different distributed ledgers (like swapping Ethereum and Bitcoin) can be more complicated, often requiring additional tools or networks to make the trade happen.

- There may be higher fees too, for instance, there could be high gas fees on blockchains like Ethereum, which could make small transactions uneconomical.

- DEXs can be confusing for newbies, their interfaces are less beginner-friendly and they require some technical knowledge about the blockchain and knowing how to set up crypto wallets like MetaMask.

- There’s usually no customer support to turn to if something goes wrong.

- Fewer pairs may be available compared to centralized exchanges, at times the availability of a pair totally depends on the platform, for instance, Uniswap is Ethereum-based and supports tokens within this network, similarly, PancakeSwap supports Binance Smart Chain tokens.

- Although they’re typically considered secure since they’re hosted on user-owned distributed nodes, DEXs are still prone to smart contract code vulnerabilities like bugs or exploits.

Peer-to-Peer (P2P) Exchanges

Examples: LocalBitcoins, Paxful, Binance P2P, Bisq, Hodl Hodl

Peer-to-peer exchanges are another path, directly connecting individual buyers and sellers without anyone else getting involved. These platforms provide privacy, lots of flexibility and freedom to set your own terms.

How do crypto exchanges work in the P2P case? Trading on P2Ps is personal, helping people negotiate terms independently. Such platforms let sellers list their offerings, setting their own prices and terms for transactions, and a buyer goes through the listing to find a match. An escrow service is a common practice on P2Ps to ensure that both parties completed their part of the “deal” by holding the assets in escrow until the obligations are fulfilled but letting them stay anonymous.

Advantages of P2P Exchanges

- There are no middlemen or central authorities controlling the process of the trade, so the transactions are direct between parties.

- You can negotiate your own terms (prices, payment methods, and so on) without intermediaries.

- With P2Ps, a bank transfer, cash deposit, using services like PayPal, or hundreds of payment methods is possible.

- Peer-to-peer exchanges charge platform fees, yet they are normally lower than what central exchanges charge.

- Identity verification varies, sometimes it’s minimal and the P2P asks only for basic information (e.g., LocalBitcoins), some platforms like Bisq or Hodl Hodl prioritize privacy and confidentiality, allowing anonymous transactions without required KYC or sharing personal information.

- Platforms often offer an escrow service that releases the purchased crypto assets from the seller once the buyer completes the payment.

- P2Ps typically have a global reach and connect people from different parts of the planet, making it a good choice for regions that don’t have access to CEXs.

Disadvantages of P2P Exchanges

- Finding a match, favorable prices, and manual negotiation may take time, negatively affecting the trade speed.

- There may be really big price discrepancies since people decide themselves what to trade and on which terms.

- Liquidity is typically limited, popular currencies like Bitcoin are usually available, but less-known altcoins and trading pairs can be limited because some currencies aren’t listed by sellers.

- It’s all about trust, agreements, and confirmations between people, so scams and fraud can be possible, plus the exchange doesn’t vet its users in detail, so disputes can occur.

Crypto Exchange Comparison

So, when should you use each of the options? Here’s a table summing up what was mentioned above.

| Feature | Centralized (CEX) | Decentralized (DEX) | Peer-to-Peer (P2P) |

| Examples | Binance, Coinbase, Kraken, Gemini | Uniswap, PancakeSwap, SushiSwap, dYdX, Curve Finance | LocalBitcoins, Paxful, Binance P2P, Bisq, Hodl Hodl |

| Best for | Crypto exchange for beginners, on-platform storage is available | Having control over your own funds, anonymity during transactions | Direct trading without middlemen, anonymity, negotiating your own terms |

| Liquidity | Generally high liquidity and trading volumes | Liquidity and trading volumes are typically lower than on CEXs | Liquidity is typically limited, depends on users and the platform |

| Anonymity | Low, in-depth customer identity verification like KYC is required | High privacy and anonymity for users, no central regulating authority, KYC is skipped | Depends on the platform: either minimal KYC or completely anonymous |

| Ease of Use | Simple and user-friendly, customer support available | Medium complexity, some technical knowledge is needed | Moderately simple, can vary from platform to platform |

| Currencies and Trading Pairs | Large variety of currencies from mainstream to niche, many pairs like fiat-to-crypto, crypto-to-crypto, etc. | Depend on the blockchain, could list rare tokens unavailable on CEXs, fiat-to-crypto conversions usually aren’t supported | Popular cryptos are available, less-known altcoins and trading pairs depend on what sellers list, prices and payment methods are negotiated |

| Crypto Exchange Fees | Moderate exchange fees | Blockchain fees can be high | Platform fees are low |

| Crypto Exchange Security | Uses the custodial model and stores users’ private keys, could be subject to crypto exchange hacks | Uses the non-custodial model and doesn’t store users’ assets, smart contract vulnerabilities are possible | Moderately secure, offer escrow services, but you can face scams and fraud on these platforms |

How to Choose a Crypto Exchange

Selecting which exchange path to follow depends on various factors. These are several basic points worth noting:

- If you’re completely new to crypto, then a centralized exchange may be a good start since they’re user-friendly.

- If you want your transactions to be anonymous, then a DEX or P2P could be the way to go.

- You won’t be able to acquire crypto for fiat money on DEXs, so if you want to use US dollars or convert local currency into crypto, then it’ll be possible on a CEX like Coinbase offering fiat-to-crypto conversions.

- If you’re seeking some rare cryptocurrencies for trade, then you probably won’t find them on a P2P, so a DEX or CEX may be better.

- What’s for liquidity and where you can find better rates for crypto, usually CEXs have more stable pricing, although you can negotiate terms on P2Ps directly with sellers.

- If you’d like to make a profit off staking, browse what terms centralized exchanges offer for storing assets on their platforms.

- If you don’t want to entrust a third party with access to your private keys, then aim at a decentralized cryptocurrency exchange or P2P with fewer custodial risks.

What Is the Best Crypto Exchange for Crypto Gaming and Casinos?

Likewise, what you’ll be using crypto for will also affect your exchange choice. For example, are you interested in iGaming (where crypto is accepted for in-game purchases) or online crypto casinos (like BitStarz, Stake.com, and others where you can gamble, play casino games, or place bets with crypto)?

You can get mainstream tokens like Bitcoin, Ethereum, Litecoin, Tether, or other types of cryptocurrency and stablecoins that are accepted in most online casinos and cryptogaming platforms on practically any exchange type. But since immediacy is often important for iGaming and online casinos or if you plan on using fiat money, centralized exchanges could be more optimal for instant transactions.

Some centralized exchange platforms like Crypto.com allow you to tie your VISA card to a crypto balance, simplifying gaming-related purchases. So if this is an important point for you, a centralized cryptocurrency exchange could be an option.

If you’re in a region where CEXs are unavailable, you can get widely supported cryptocurrencies on a P2P like Paxful or LocalBitcoins. They often have payment option diversity that can include bank wires, cash, Paypal, or even local payment options.

Popular blockchain-based games such as The Sandbox (SAND), or Decentraland (MANA) have token-based purchases. However, many of them have native, game-specific tokens or NFTs. For instance, players use custom AXS tokens or Smooth Love Potion (SLP) for games like Axie Infinity or use BCOIN for games like BombCrypto. In case you need unique utility and gaming tokens, you’ll most likely have to go to a decentralized exchange like Uniswap, SushiSwap, or PancakeSwap where you can exchange ETH, USDT, or other popular crypto for them.

Decentralized exchanges may be trickier for those who don’t know how to use a crypto exchange or aren’t familiar with wallet setups or blockchain technology. But you should consider them not only for niche gaming tokens. DEXs are a great choice if you’re privacy-conscious and value anonymity, and they also let you retain full control of your funds, which is safer.

Finally, once you’ve decided which exchange type is a better fit, compare the fees and terms to find the best crypto exchange platform. As such, you may discover that some platforms are unavailable in your region, that a certain exchange doesn’t have a trading pair, cryptocurrency, or token you need, or has unfavorable pricing, deposit, or transfer terms.

Cryptocurrency Exchange vs. Crypto Wallet

We’ve mentioned wallet setup and crypto storage a few times up to this point. How is a cryptocurrency exchange different from a cryptocurrency wallet?

A cryptocurrency wallet is a solution designed for securely storing crypto assets, specifically, for storing keys that give access to someone’s crypto. They could be categorized as custodial and non-custodial, as well as hot and cold wallets.

- Cold wallets are typically offline and applicable for long-term storage and higher security. They could be something as basic as a private key or seed phrase printed out on a piece of paper or a hardware wallet like Ledger which is a physical device similar to a USB drive that’s only connected when necessary. In both cases, users are responsible for safeguarding their wallet storage and private keys from theft.

- Hot wallets are online ones that either come as a standalone service like MetaMask or are integrated directly into centralized exchange platforms like Coinbase. In the latter case, users trust a third party for storing their assets and this option is often preferred for trading convenience and short-term storage of small amounts due to lower wallet security.

So, what is the difference between crypto exchanges and crypto wallets? Essentially, a crypto exchange is a platform where you can trade, purchase, or sell Bitcoins or other crypto. If it’s a centralized exchange like Coinbase, it usually comes with a built-in on-platform crypto wallet, and the exchange takes custody and controls the user’s funds. Decentralized exchanges and P2Ps, on the other hand, don’t come equipped with their own wallets, they are non-custodial, so users have to separately set up their own wallets for storing their crypto assets, choosing a standalone hot wallet option like MetaMask, a cold wallet device like Trezor, or a combination of both.

In either case, users can have multiple wallets. For example, a person can have an account and wallet on Kraken and use the funds stored within this centralized exchange for frequent transactions. At the same time, they can have a hot wallet like MetaMask to use for decentralized exchanges or P2Ps and cold storage like Ledger at home for long-term storage of larger funds.

Should You Store Your Crypto on a Centralized Exchange?

Centralized exchanges typically hold an interest in users storing crypto assets within their ecosystem, as this increases the CEX’s liquidity. This is partially why many of them provide opportunities for staking and convince people to lock up their holdings in the platform’s built-in wallet for a long period of time if they want to earn rewards or interest.

Of course, the opportunity to get passive income can be stimulating. Nonetheless, it is considered a best practice to store large amounts of crypto in cold offline wallets rather than in the hot wallets provided by the exchange. With a hardware wallet, you control your private keys and crypto assets, so you truly own them.

Leaving funds in an online digital currency exchange has many risks since user assets are managed by the platform which can potentially get hacked. If there’s a security breach you can lose both your funds and sensitive personal information. Plus, if you’re using a lesser-known exchange, it can go bankrupt or shut down. Exchanges have collapsed before, and hundreds of people lost their funds forever. For example, as a result of the FTX collapse in 2022, there was a loss of about 8 billion USD in customer funds.

| Crypto Exchange Wallets | Non-Exchange Crypto Wallets | |

| Best For | Frequent trades, short-term storage | Long-term storage |

| Private Keys Control | Held by the exchange | The user controls their own private keys and recovery phrases |

| Ease of Use | Simple in use | May require more setup and maintenance effort |

| Security | Centralized exchanges are common targets for hackers | Stronger security with self-custody |

| Risks | Higher hacking risks, plus centralized control exposes users to regulatory threats | Risk of physical loss, cold wallet damage, or the owner compromising the wallet |

| Responsibility | Shared responsibility with a third party | The user is entirely responsible for safeguarding their wallet |

| Insurance and Recovery | The exchange may offer insurance and can have backup or recovery measures | No customer support to turn help retrieve the keys, if the physical wallet device or recovery phrase is lost, funds are lost |

Crypto Exchange Limits

As you might have guessed, you’ll likely have to pay a fee for moving your digital assets off the exchange. Which other fees and limits can you encounter? There are withdrawal limits, transaction caps that restrict how many trades you can make per day, and spot trading fees that often make small frequent trades unfavorable, especially for beginners. We’ll bring up a couple of commission examples, but feel free to browse the details and latest fee schedules directly on each platform’s official website.

The prices for crypto are often more stable on centralized exchanges and the transactions there are quick but this comes with its own cons. For example, Binance places limits on transactions based on a user’s level of verification, if the account is unverified, there could be additional daily withdrawal limits. Or Coinbase charges a 5% recovery fee if a user needs asset recovery. Here are the fees of a few popular CEXs.

| Binance.US | Coinbase | Kraken | Gemini | |

| Trading Fees (Low-Volume) | For makers: 0.38% | For makers: 0.40% | For makers: 0.25% | For makers: 0.2% |

| For takers: 0.57% | For takers: 0.60% | For takers: 0.40% | For takers: 0.4% | |

| DepositFees | Free | Free | Often free | Free |

| Credit/Debit Purchase Fees | ~3.5% | 3.99% | 3% to 4.5% | ~3.49% |

| Withdrawal Fees | Varies (based on the withdrawn currency) | Free to a bank account, ~1.5% of the amount for instant debit card withdrawals | Varies (based on the withdrawn currency and method) | Varies (based on the withdrawn asset and network) |

Decentralized cryptocurrency exchanges have network transaction fees called gas fees, charged for executing operations on the blockchain of the DEX like Ethereum or BSC Binance Smart Chain. These costs are applied to compensate minors who process and validate the transactions. As such, Uniswap, PancakeSwap, and SushiSwap have 0.3% trading fees, split between the platform and liquidity providers. But since these DEXs rely on gas fees, they can spike during periods of high network activity and demand. On the bright side, DEXs typically don’t charge additional withdrawal fees, apart from the required gas fees.

There are also peer-to-peer cryptocurrency exchange limits and fees for trades made via the platform, as well as for its escrow services. For example, LocalBitcoins charges a 1% to 2% transaction fee of the trade value, the buyer fees are around 0.5%, and the sellers usually pay 1% for listing their trade. Similarly, another popular P2P, Paxful’s transaction fees are 0% to 5% depending on the chosen payment method as well as the status of the buyer and seller, and a 1% trading fee for matches.

Crypto Wallet and Crypto Exchange Security Best Practices

Protecting your crypto assets thoroughly is crucial if you don’t want them stolen. What can you do to safeguard your crypto both in wallets and on exchanges?

Choose a Safe and Reputable Exchange

If you’re planning on using a crypto exchange wallet provided by a centralized exchange, first make sure that you’ve selected a reputable, regulated, and secure cryptocurrency exchange platform. Since a CEX acts as a custodian and you’re going to entrust them with your private keys, the exchange has to be trustworthy.

If you think that scam exchanges and fake tokens are make-believe, you’re wrong. Plenty of platforms try to deceive users and steal their funds, mimicking legitimate exchanges or even making their clones with similar URLs and logos. They often attempt to trick users into providing their private keys or login information or making deposits, vanishing soon afterward with user funds.

Many of such fraudulent exchanges have great interfaces and could look professional. They typically offer low fees, promise sky-high profits, guarantee “little risk” returns on cryptocurrency investments, or too-good-to-be-true prices or terms. PlusToken is a bright scam exchange example, it gained popularity in Asia and attracted users with its unrealistically high returns, ripping off over $2.9 billion USD in 2019 before disappearing. While OneCoin was a non-existent cryptocurrency that was around for several years, it lured people to become investors and scammed them for billions in 2017.

So do your research and think twice before registering on some no-name platform that could have mediocre security measures, no recovery options, and no customer support to turn to. For example, some platforms like Coinbase offer crypto exchange insurance policies that can cover some forms of loss in case of theft.

Negative reviews on Reddit, TrustPilot, or crypto forums, “free cheese” offers, lack of customer support, no registration, or no centralized exchange regulation are red flags to watch out for. Visiting official app stores to get verified exchange apps may be a good first step. Additionally, find out as much as you can to verify the CEX’s legitimacy and check for regulatory compliance. Make sure it really has crypto trading and that it’s not some unknown token. Look for scam reports and past incidents, and be cautious of suspicious offers.

Strengthen Your Account Security

Make sure to set strong passwords when signing up and making your account. It is best to generate a unique and complex password that’s not used anywhere else. Opt for something non-obvious and mix cases, digits, and symbols and store it somewhere safe like in a password manager.

Multiple layers of security are a good idea. Enabling two-factor authentication (2FA) can let you protect your account even if the password gets compromised on or off the secure exchange. An app-based time-sensitive two-factor authentication code is considered safer than one sent via SMS.

It also makes sense to monitor your account from time to time so that there isn’t any extraneous activity you haven’t authorized. If you do notice something odd, report it to the platform’s customer support. If you don’t want to fall prey to phishing attacks, don’t click on links to websites from emails, pop-ups, ads, or sources you don’t know, as they can lead to stolen credentials.

Use Storage Off the Exchange

If it’s possible, limit the amount of crypto you store on the exchange’s platform since this can lower your risk of losing the assets to a security breach. Consider moving your digital assets to a personal wallet, be it a software or a hardware one that’s less vulnerable to cyberattacks. Having a self-custody non-exchange wallet can be a good idea since you’ll control the private keys to your funds. As long as you don’t lose them, no one else will have access.

What to Do If the Exchange Gets Hacked

At times even a secure crypto exchange can become a target for hackers, and large sums of crypto get stolen. Here are a few centralized exchange attack cases that prove that even reputable platforms are at risk.

Have you heard about what happened in 2014? Mt. Gox was a digital asset exchange that used to handle over 70% of Bitcoin transactions around the globe went bankrupt after a major hack. Approximately 850 thousand Bitcoin funds then worth more than $450 million USD were lost and never recovered despite lengthy legal proceedings.

In August 2016, hackers took advantage of the security breaches in Bitfinex’s systems, leading to the theft of around 120 thousand BTC from users’ wallets worth around $72 million USD at the time. The exchange reimbursed users with BFX tokens afterward in proportion to their losses, and people had the chance to convert or redeem them, but there was lots of aftermath.

Even the famous exchange Binance was successfully attacked in 2019 because of its security vulnerabilities. Over 7 thousand Bitcoin worth about $40 million USD were stolen, but the platform covered the losses since it was Secure Asset Fund for Users (SAFU) insured.

There may be other consequences apart from significant financial losses. As such, Japan introduced much stricter regulatory control after the Coincheck exchange attack in 2018 when hackers stole NEM tokens worth $534 million USD from users.

What does this mean for hack victims? Well, if the exchange isn’t insured from cyber theft cases, you risk losing everything you have on your crypto balance if there’s a security breach. Large-scale hacks hit the reputation of exchanges hard, leading to the domino effect of massive asset withdrawal, lower trading volumes, decreased activity and liquidity, increased market volatility, and price fluctuations. High-profile hacks can also attract the regulators’ attention, which may result in stricter regulations making many users switch to DEXs.

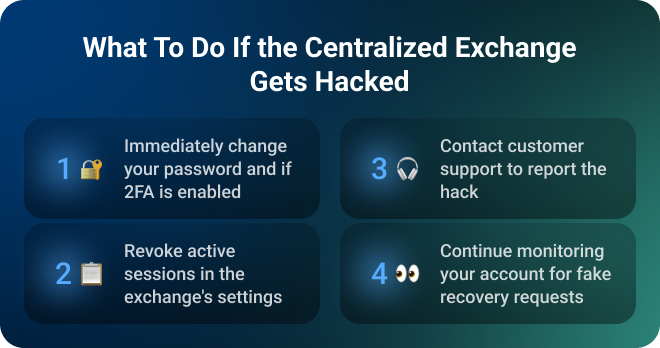

What should you do if a hack happens? If you think that your account could be compromised, there’s unauthorized access or suspicious activity:

- Immediately change your password and check whether two-factor authentication is enabled.

- Then go to the exchange’s account or security settings to revoke active sessions. Any ongoing sessions have to be terminated to cut off access from those attempting to hack you, this won’t let other people make transactions. Usually, there’s a list view, displaying all active sessions with details like the location and time of the session and the used device type, so choose the ones you want to revoke.

- Next, reach out to the exchange’s customer support to report the hack. If something was stolen and your exchange has an insurance program for reimbursement, you’ll have to follow the platform’s outlined procedure.

- Continue monitoring your account for some time as there could be repetitive hacking attempts such as fake recovery requests.

Crypto Exchange Regulation Impacts

As we’ve mentioned earlier, centralized cryptocurrency exchanges have various government regulations and restrictions because they try to control financial systems. On the one hand, regulation on any given digital currency exchange platform is needed for investor protection, security, and laundering prevention. On the other, this:

- significantly impacts the accessibility of CEXs;

- influences the operations of centralized exchanges (e.g., limits their offerings or prevents them from listing specific tokens or currencies);

- forces licensing for approval to operate in a country;

- makes proof of identity like KYC (Know Your Customer) and AML (Anti-Money Laundering) or other procedures obligatory;

- poses other challenges like potentially frozen or confiscated funds as a result of regulatory action;

- can be fined and face shutdowns.

Some exchanges can have geographic limits and may not be available in certain regions or countries, especially if they’re under international sanctions. In other words, your country of residence can determine whether you can access a certain exchange or not. For instance, China shut down domestic crypto mining and banned local exchanges in 2017, making them illegal, while there’s still regulatory uncertainty in India regarding crypto.

Either way, exchanges have to adhere to local laws in order to legally operate in the jurisdiction. Japan requires that cryptocurrency exchanges get a license from the Financial Services Agency, stopping an online exchange like Bitfinex that didn’t manage to secure it from operating in the country. The UK requires registration with the Financial Conduct Authority (FCA) and Germany’s Federal Financial Supervisory Authority (BaFin) also has licensing requirements for crypto custody and trading. Brazil doesn’t have specific laws but applies general financial regulations, whereas Russia has laws regarding digital financial assets and digital rights.

Australia’s Securities and Investments Commission has guidelines for crypto-assets as well as an Anti-Money Laundering and Counter-Terrorism Financing Act. Similarly, Canada has a money laundering and Terrorist Financing Act too.

The situation with global exchanges in the USA is tricky as they have to comply with both state and federal laws, making many exchanges unavailable or forced to adapt to US regulations. Giving a few examples, US citizens have restricted access to the global version of Binance but can use the separately created Binance.US branch that operates under different regulations. Bitfinex is completely off-limits and access to some advanced trading options provided by Kraken is restricted. Alternatively, some platforms like Coinbase and Gemini were designed specifically for the US market.

What should you do as a user? It is advisable to check whether the crypto exchange you want to use is accessible in your country and whether it adheres to local laws. If you find out that it doesn’t fit into your region’s regulatory environment, look for available alternatives. Trying to bypass the geographical restrictions by using a VPN or other means can be a violation of the CEX’s terms.

Final Thoughts on Cryptocurrency Exchanges

Users go to digital currency exchange platforms to buy, sell, and trade various cryptocurrencies. They are a convenient way to convert and obtain crypto assets to use for trading, crypto gaming, online betting, or other endeavors. To ensure the safety of your investments, it’s highly recommended to take proactive steps to secure your crypto assets and personal data and store larger quantities of crypto in cold wallets. We’ll uncover more secrets and tips on securely storing your assets in the next section.