As previously discussed, cryptocurrency wallets are essential digital tools that make it possible for users to safely manage their crypto assets, providing a secure way to store and transfer them. Yet, when it comes to the specific storage options, you’ll face the choice of using either a hot or cold wallet or even a mix of both. On this page, we’ll spell out the differences and use cases for each.

Key takeaways:

- Hot wallets are online-based and intended to facilitate interaction with various blockchain applications, exchanges, and services.

- In contrast, cold wallets are robust offline storage solutions, they’re more like secure vaults for crypto assets.

- Hot wallets are optimal for frequent, everyday transactions, while cold wallets are better suited for long-term cryptocurrency storage.

- Many utilize both wallet types to get a hold of both convenience and security.

What Is a Hot Wallet?

Hot wallets are crypto wallets that are constantly connected to the Internet. Such continuous online connectivity provides quick access to the assets and makes it easier and faster to trade cryptocurrency. Hard wallets usually imply installing software to your smartphone or laptop, similar to an app, or may be offered by a crypto exchange as an in-built feature.

What is a hot wallet best used for? A crypto hot wallet is ideal for active traders and frequent crypto users. It’s an optimal choice for those making daily transactions but isn’t the best option for storing large amounts of crypto in the long run.

Types of Hot Wallets

Hot storage can come in various forms, and these are the most common kinds you can encounter:

- web-based wallets (accessible through a web browser using an extension, a website, or a web app, some popular examples are MetaMask, CoinBase Wallet, and Binance Web Wallet);

- mobile wallets (designed for smartphones and accessed through a mobile app, some examples are Trust Wallet, Exodus, and Mycelium);

- desktop wallets (accessed via computers through installed software, such as Armory, Jaxx Liberty, and Electrum);

- crypto exchange wallets (custodial wallets that are provided and managed by an online cryptocurrency exchange platform like Coinbase or Kraken).

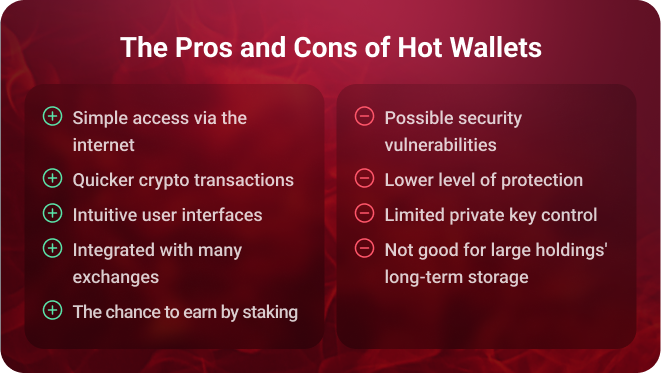

Hot Wallet Pros

Most likely, you’ll start your crypto journey with this type of wallet. What are the benefits to count on? Let’s overview the main advantages of hot wallets.

1. Simple access — as long as you have an Internet connection, you have access to the hot wallet, which makes regular trading activities much easier.

2. Rapid transactions — when you don’t need to go back and forth between online and offline wallet modes this facilitates quick crypto transactions.

3. Great user experience — hot wallets customarily have intuitive interfaces and are super easy to use even for newbies who are just learning what is crypto, you just log in and begin engaging with crypto platforms and apps.

4. Exchange integrations — numerous hot wallets work directly with cryptocurrency exchanges, which definitely streamlines trading for many users.

5. The chance to earn by staking — some crypto exchanges offer rewards or interest for storing assets on their platform’s hot wallets, however, before you decide to lock in any crypto there, ensure that it’s as secure as it can get.

Hot Wallet Cons

Fast access, simply buying crypto and selling it, the potential to earn something just by storing your assets. What’s the catch? The major hot wallet crypto disadvantages are as follows.

1. Possible security vulnerabilities — since they’re online all the time and store private keys online as well, hot wallets can’t be completely safe from cyberattacks, meaning there’s always a risk that the assets could be stolen.

2. Lower level of protection — although a lot is continuously done to make their security unapproachable, even the best hot wallets can’t compare to what’s offered by fully offline storage solutions.

3. Limited private key control — by choosing a hot wallet, you entrust a third-party service provider to store and safeguard your private keys, meaning that users don’t have full control over their keys.

4. Not suitable for large holdings — long-term storage of significant crypto amounts isn’t usually the strong suit of hot wallets, as they’re inherent to online hacks and risks, it’s inadvisable to rely on them for that.

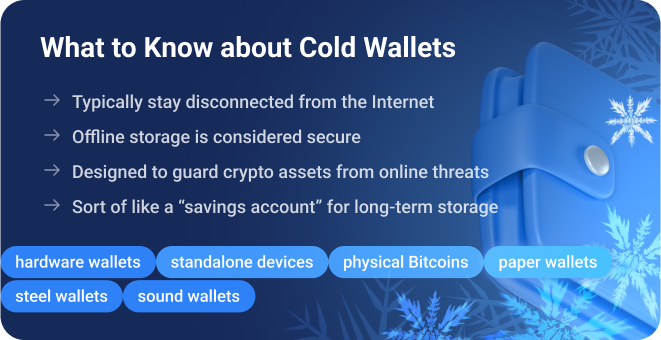

What Is a Cold Wallet?

Commonly referred to as cold storage, the word “offline” is the centerpiece of the cold wallet meaning. Such solutions typically stay disconnected from the Internet and are designed to guard crypto assets from online threats, which is why they are considered secure. You can think of them as a well-protected “savings account” where you could store most of your funds.

What’s a cold wallet best used for? Cold wallets are well-suited for long-term asset storage as they are good at shielding them from unauthorized access. If you’re not planning on making frequent transactions and prefer to have complete control over your crypto, this kind of wallet could be optimal.

Types of Cold Wallets

What can make crypto storage safe from online hacking attempts? As you might have guessed, keeping the keys offline. There are a few popular ways to do that:

- hardware wallets (a physical device that you purchase to store your keys offline, they often resemble small to medium-sized USB drives that you only connect to another device when performing a transaction, some examples include Ledger Nano, Trezor One, and KeepKey);

- paper wallets (literally just a printed piece of paper with your crypto keys, be they numerical or in QR code format, you can generate a paper wallet using BitAddress.org, MyEtherWallet, WalletGenerator.net, or similar services);

- steel wallets (in this case, private keys are engraved onto durable metal to prevent information loss due to damage, you can order them on Cryptosteel or from a local artesian);

- sound wallets (a novelty storage method that encodes private crypto keys as audio files on different media formats like MP3);

- standalone devices (a separate computer or another smartphone that’s disconnected most of the time and used mostly for storing cryptocurrency);

- physical Bitcoins (a cold storage Bitcoin method that implies obtaining actual physical coins or tokens representing a specific amount of Bitcoin and usually have a private key hidden under a seal).

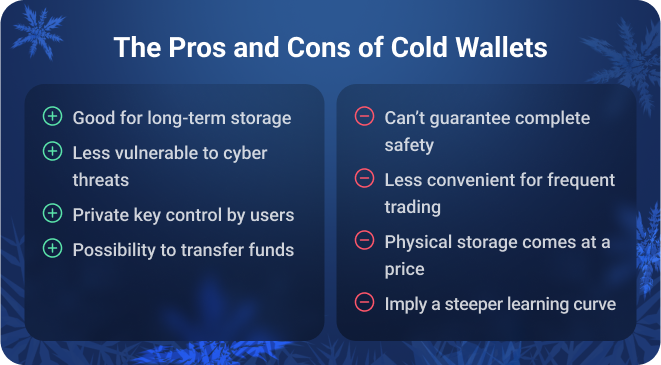

Cold Wallet Pros

As you see, such wallets are rather reliable storage options. These are the main advantages of cold storage crypto.

1. Good for long-term storage — an often used solution for holding large quantities of cryptocurrency and storing it over the long haul.

2. Generally secure — they are less vulnerable to cyber threats due to being primarily offline, you have to physically possess a cold wallet and need the passwords to get access.

3. Private key control — users can enjoy complete control over their private keys, making them the only ones responsible for their safekeeping.

4. Possibility to transfer funds — cold wallets don’t mean that the assets are locked in forever, you can take a few steps to move them when necessary, say, to a hot wallet.

Cold Wallet Cons

Are there drawbacks though? Obviously, this category of crypto wallets has its disadvantages too. For one thing, there’s no shared responsibility with a third party if you opt for this type.

1. Can’t guarantee complete safety — cold wallets minimize cyberattack risks, but, after all, human error can happen, for instance, a physical wallet could get lost or stolen, keys printed on paper may get copied or damaged, or a person can forget to disconnect the hardware wallet linked up via Bluetooth, WiFi, or USB, leaving it vulnerable to attack.

2. Less convenient for frequent trading — even though they excel in security by remaining offline, cold wallets sacrifice convenience. If you want to trade regularly, you’ll need to take the additional step of connecting the offline wallet and transferring the funds before making the trade.

3. Come at a price — unlike hot wallets that are typically free of charge, cold ones like hardware wallets may fall anywhere from 50 to 200 USD per piece.

4. Take time to set up — you’ll have to devote some time to get the handle of things with cold wallets since they imply a slightly steeper learning curve.

A Few Notes on Wallets and Keys

You won’t do without crypto wallets and keys if you’re planning to engage in purchasing and trading such assets. As shortly mentioned before, every wallet has public and private keys:

- A public key is like a bank account number, it’s an address for incoming and outgoing transactions.

- A private key is your password or secret code, which grants you access to stored cryptocurrency and lets you manage it.

While the first one could be shared with others, the latter must remain confidential because this uniquely generated string verifies that you own the crypto and is obligatory for authorizing transactions. That said, you have to wrap private key information in cotton wool and keep it as safe as you can.

Wallet Safety Precautions

Nonetheless, don’t be under the delusion that crypto wallets are entirely safe. No storage method can provide absolute security, and it’s pretty fair to say that the more user-friendly and feature-rich a storage solution is, the more prone to threats it is. So it doesn’t go down to just choosing between a hot vs cold wallet.

For instance, even some cold storage for crypto comes equipped with wireless connectivity or Bluetooth, which, if accidentally left on, could potentially expose the assets to hackers. This is why adhering to safety precautions should be your top priority, regardless of the selected wallet type. Here are a few best practices:

- To preserve your hot wallets, choose in favor of reputable ones with enhanced security and update the apps regularly. Plus, enable two-factor authentication and give your PIN codes and passwords some due thought (the more intricate they are, the better).

- To protect your cold wallets, ensure they are disconnected when you’re not using them for transactions and that your keys are well-stored. Make backup copies and be alert regarding their physical storage.

Hot Wallet vs Cold Wallet: A Side-by-Side Comparison

How are cryptocurrency hot wallets different from cold wallets? Let’s take a look at the two

in this detailed comparison table.

| Hot Wallets | Cold Wallets | |

| Best for | Frequent crypto trading | Long-term storage |

| Access and Connection | Instant connection, as long as you have Internet, your transactions can be processed online right away | Typically isolated and offline, only temporarily connected with another device using WiFi, Bluetooth, USB, etc., to move funds |

| Convenience | It’s easier to trade and check your crypto balance with a hot wallet | There are extra steps required when you retrieve your funds, which can be a hassle if you transfer crypto regularly |

| Security and Vulnerability | Average, since it’s online, there’s a chance it will get hacked | Highly secure, unless you blast your private keys all over the Internet, your funds are safe |

| Loss Risks | Medium, recovery options are usually available to access your account and wallet | Physical risk, if you lose your private keys or the cold wallet gets damaged, you may lose your crypto funds forever |

| Custody | You entrust your private keys and asset safety to a third-party wallet provider | Full custody over the private keys on the user’s end |

| Long-term Storage | Not good, the longer any information is kept online, the greater the chance hackers will gain access to it | Suitable, since they’re more secure, you can park large amounts of crypto there for a long time |

| Price | Cheap, most of the time, you don’t need to buy anything to use it | If it’s hardware, it may cost approximately 50 to 200 USD per device |

| Maintenance | Medium, requires updates now and then like any downloaded app to get the latest security fixes and so on | Low, there’s no software or antivirus to constantly update to ensure that there are no security weaknesses to exploit |

Table: Cold wallet vs hot wallet compared

So, Which Should You Choose, Hot or Cold Wallets?

Keeping in mind the ups and downs covered in the cold vs hot wallet comparison above, segregation is actually a common scenario. Who said you can’t get the best of both and have to settle for just one option?

Getting a combination is a smart approach. You can make the most of the tandem: use the cold wallet’s enhanced security and enjoy the hot wallet’s quick access. Many store a fraction of their crypto on the hot wallet to use for trading or earning interest from staking. What is cold storage crypto handy for in this case? For keeping the rest of your savings behind the locks for extended periods, and you may always transfer more to the hot wallets when required.

Sure thing, the industry progresses. Over time, the security of hot wallets is becoming more robust, while cold wallets are getting more user-friendly. Interestingly, there’s even such a thing as a warm wallet. It’s somewhat of a hybrid, mixing the two aforementioned types. These software-based solutions are downloadable yet have manual transaction authorization, so they’re like a middle-ground blend with enhanced security and accessibility.

Major Takeaways on Hot Storage vs Cold Storage

There, now you know what is a cold wallet crypto, when it’s applicable, and how it differs from hot wallets. The bottom line is that you’re free to use both types, as each has its strengths not to pass on if you want to keep your assets secure. In our next chapter, we’ll talk about the safest ways to store crypto.